What Cannabis Companies Need to Know About IRS Audits

Though threat of a cannabis company IRS audit has been increasing, a recent ruling makes it a bit more ominous.

Though threat of a cannabis company IRS audit has been increasing, a recent ruling makes it a bit more ominous.

Table of Content

It’s not like anyone should be surprised that legalization comes with a few trade-offs. The benefits of legal status come with tax obligations, regulation, and of course, the potential for audits – just like any legit business operation.

It’s just that when it comes to the IRS, many companies experience the worst of the legal and illegal worlds. On the one hand, legalization opens the door to new opportunities – chief among them, the ability to operate out in the open.

On the other, they’re subject to more scrutiny and locked out of some of the same benefits their counterparts in more traditional sectors take for granted – the ability to expand into new markets or secure a line of credit.

The tax challenges cannabis companies are currently dealing with stem from several converging forces – namely, the uncertainty that comes with trying to regulate a new industry that’s subject to a patchwork quilt of laws and regulations.

In this article, we’ll explain why cannabis businesses are uniquely vulnerable to IRS audits and examine some of the factors at play. We’ll also discuss some things you can do to protect your business despite all of the complexities.

Cannabis businesses face more scrutiny from the IRS than your average SMB. In large part, this unwanted (and expensive) attention comes from the fact that exploiting the confusing nature of the space and the inevitable slip-ups that come with the territory is incredibly lucrative.

While there’s certainly more going on beneath the surface, here are three key factors exacerbating the current situation.

Cannabis companies (and their allies) fought for years to legitimize their operations.

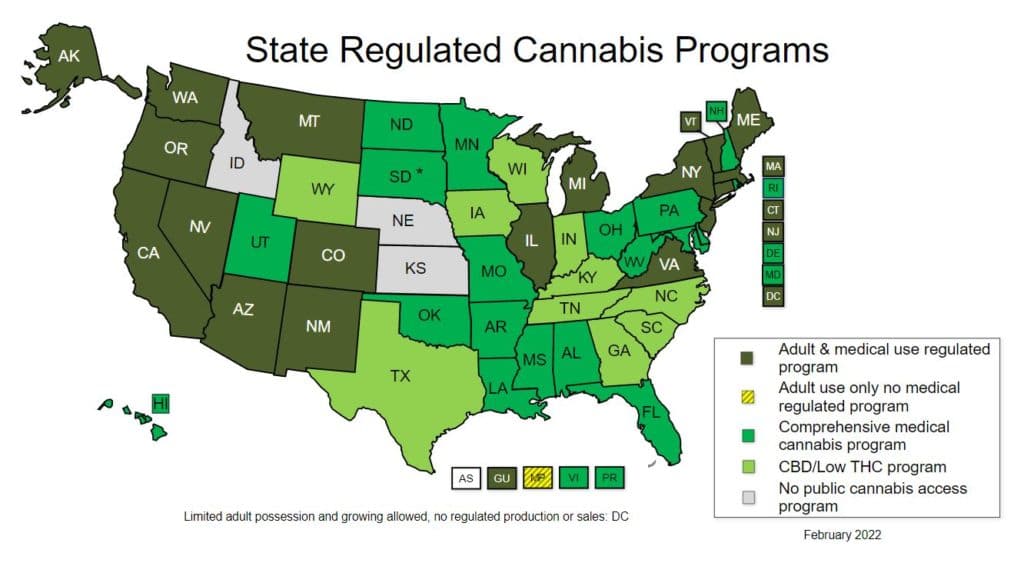

And – as of February 2022, cannabis is now legal — at least in some capacity — in more than 75% of states.

Yet, federal guidance re: tax reporting remains hazy, at best.

Part of the problem is there’s a lack of alignment between local, state, and federal legislation.

Individual states license and regulate cannabis operations, yet cannabis remains an illegal, Schedule I substance under federal law.

The other key factor is Section 280E of the IRS tax code.

Enacted in 1982, 280E is a relic of the War on Drugs – aimed at preventing people from writing off the expenses of making or distributing illegal drugs on their personal tax returns. In other words, 280E exists so that you can’t get a tax write-off for, say, overhead expenses for distributing cocaine or the raw materials required to cook meth.

Essentially, 280E prohibits any deduction of business expenses if the taxpayer’s business or trade deals in “trafficking a controlled substance.”

Unfortunately, because cannabis is still classified as a Schedule I drug, the law still blocks (legitimate) cannabis operations from filing run-of-the-mill business expenses.

But here’s where things start to get weird: the IRS Revenue Code (IRC) doesn’t actually differentiate between income generated through legal means and income generated via illegal activity. And – per the IRC, all income is taxable and therefore, must be reported on your tax return.

Section 280E doesn’t prohibit cannabis companies from applying deductions or tax credits to reduce gross receipts and calculating the cost of goods sold to determine gross income. But, it does prohibit cannabis companies from deducting the kinds of expenses you’d find on pretty much any business tax return. Think – marketing, advertising, rent, new equipment, and so on.

It’s hard to figure out what you can and can’t write off – and the IRS guidelines seem, well, counterintuitive. Ultimately, confusion can get you into hot water with the IRS – even if you’re doing your best to do everything by the book.

Finally, the IRS wasn’t spared from the fallout of the COVID crisis.

Shutdowns, job losses, and extensions forced the federal tax agency to delay a large chunk of its routine work. Think – collections, audits, and IRC enforcement. Now they’re catching up and apparently, audits are back on in full force.

According to a recent article from MJBizDaily, cannabis industry tax experts are warning clients to brace themselves against a coming tsunami of audits targeting their 2019 tax returns.

In it, Denver tax attorney, Rachel Gillette noted that she’s seen a significant increase in audit notifications going out to her cannabis industry clients. Gillette also says that it’s not just in Colorado, audit notices are hitting cannabis companies in legal states across the US – California, Massachusetts, Florida, etc.

Another attorney, Dean Guske, said the IRS has started using agents to conduct audits across state lines – rather than in person (hey, maybe they’re just embracing remote work like everyone else).

Guske says his firm did ask the IRS if the uptick in cannabis-related audits was intentional or just random. As it turns out, agents have received training related to 280E and other cannabis-specific tax issues.

Additionally, the IRS seems to be going after cash filings associated with form 8300 and retailers without permits or licenses trying to launch in newly legal markets.

It’s hard to know for sure whether the IRS’ COVID comeback is about completing audits that were already in the works or if the agency sees cannabis companies as an easy way to recoup some of the revenue that was lost to the pandemic.

Look, the easy answer is, follow the tax code to a T.

The problem is, it’s easier said than done – though the IRS says it’s working on it. Late last year they launched an initiative aimed at helping taxpayers navigate the unique challenges of the marijuana industry.

According to the agency, the initiative involves collaboration and coordination with external stakeholders – and a concerted effort to make the tax reporting process more transparent and straightforward. But they’re also upfront about the fact audits are still on the table – and will still find ways to ID non-compliant taxpayers.

The above link also shares some tips for protecting your business against potential audits.

Some are a bit general, they’re worth mentioning all the same, as they can help you lay the foundation for your tax strategy moving forward.

Below, we’ve outlined some of those IRS-sponsored pointers – plus some thoughts of our own.

(Sidebar: we should note that the IRS website tends to use the word “marijuana” more often than “cannabis.” The reason this matters at all is, if you need to search for information, you’ll probably turn up more relevant results if you use “marijuana” as your primary keyword.)

Look, licensing is kind of a no-brainer. You probably know that you need to take care of this – but it’s important that you make it a priority.

As mentioned, the IRS is trained to look at newly-launched companies to make sure that they’ve obtained the appropriate licenses and permits. The point is, launching before you’ve taken care of basic admin tasks can get you flagged and audited – leading to penalties and fines down the road.

Telling companies to file and pay their returns on time is another piece of advice that feels almost too obvious to mention. But again, it’s the basic stuff that puts you on the IRS’s radar in the first place.

Sure, people file and pay taxes late all the time – often without experiencing any serious consequences beyond a late fee or some other minor penalty. At the same time, opening the door to extra expenses – regardless of what industry you’re in – isn’t great for the bottom line.

Given that cannabis is still considered a Schedule 1 drug, many companies don’t participate in the traditional banking system and instead, opt to take payments in cash or via third-party apps.

Per the IRS documentation, cannabis companies, as well as all other types of cash-intensive business operations, can be, and often are, audited.

If a company receives $10k+ in cash within a single transaction or over the course of several related transactions, they need to file Form 8300 within 15 days of receiving that payment. It’s kind of a pain, but the IRS is cracking down on companies that fail to report large cash transactions.

Additionally, the IRS says that the use of cryptocurrency is a top priority for enforcement within the cannabis industry. Per the official tax code, the IRS considers crypto currency to be taxable property – given its potential to deliver massive capital gains. With that in mind, it’s a good idea to work with a reputable exchanger if your business uses crypto in any capacity.

Anything linked to a source of income – whether it’s a canceled check, an electronic invoice, or a cash deposit – must be documented and kept in the event of an audit. According to the IRS, companies should even record expenses they can’t legally write off at the federal level.

The logic there is, maintaining a complete, accurate record makes it easier to track expenses, prepare returns, and provide answers in the event the business is under investigation. Regardless of where the IRS fits into this whole thing, good record-keeping is just good business sense – it gives you more data to work with, a realistic picture of what’s happening inside your business, and more control of your finances.

The legal conditions and tax laws that define today’s cannabis industry might be complex, even unpredictable. But – the right tech stack, with a robust cannabis ERP at its core can change the game for tax compliance, risk management, and more exciting developments on the horizon.

For example, Dynamics 365 Business Central provides accurate insights and a centralized workspace for managing licenses, permits, financials, inventory, and all relevant tax records. It integrates with state tracking systems, provides audit trails, supports tax compliance, and serves up detailed, AI-driven financial reports.

Look, we’re still in the early days of legalization. In many ways, it’s heartening to look at how far the cannabis industry has come – and how it’s evolving into this new, exciting space.

At the same time, the impacts the fragmented regulatory landscape, outdated drug classifications, and all-around confusion have on cannabis companies and their tax situations proves just how far we still need to go.

As it stands, many high-profile cannabis companies have pending cases with the IRS, leaving several aspects of tax reporting and compliance up to interpretation – at least for now.

Ultimately, the fact that the IRS can obtain financial records to investigate – and per multiple reports, target – cannabis companies, means that a comprehensive ERP solution must become an urgent priority.

Velosio’s Microsoft experts help companies implement, adapt, and optimize ERP solutions that tackle their biggest challenges and unlock new opportunities. To find out how we help cannabis companies manage financial operations, maintain compliance, and prepare for IRS audits, contact us today.